America's #1 MREA Based Tax and Accounting Firm. For Real Estate Agents.

Tax In-House is the preeminent MREA based bookkeeping firm in America. With a collaborative and education-based focus, and well over a decade of highly specific experience, we help real estate agents master "the language of business' that is accounting. Our classes have helped educate many thousands of real estate agents gain understanding into their business financials. Our flat-rate monthly service helps 100s of real estate sales businesses gain clarity into their businesses while also offloading all things S-Corp related: taxes, bookkeeping, a payroll file & guidance, tax guidance, general business consulting. Call our team of experts today!

Yes! Tax In-House works exclusively with real estate sales agents and teams. This specialization means we know the business of being a real estate sales agent/team.

Tax In-House is a national firm. Our services are available to assist real estate sales agents/teams with bookkeeping and tax services in all 50 states.

Yes! Tax In-House helps real estate agents get current on past-due tax filings. Most agents are shocked at how quickly these long-overhanging dread items can be resolved.

PS - Did you know that greater than 20% of real estate agents are behind on their tax filings?

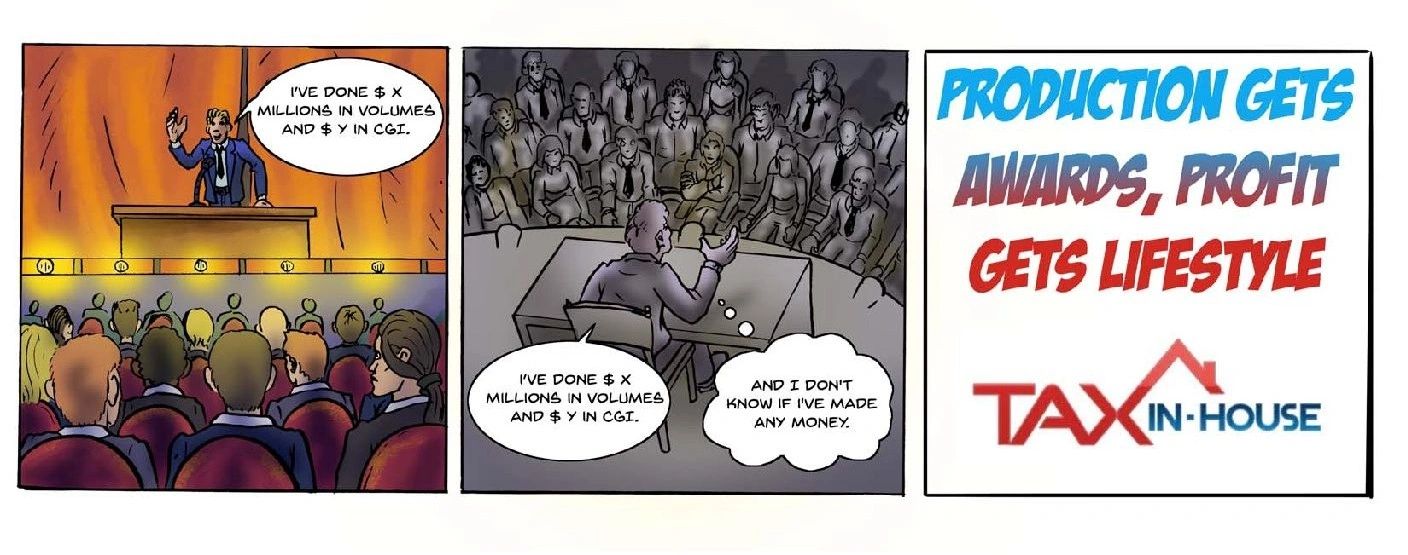

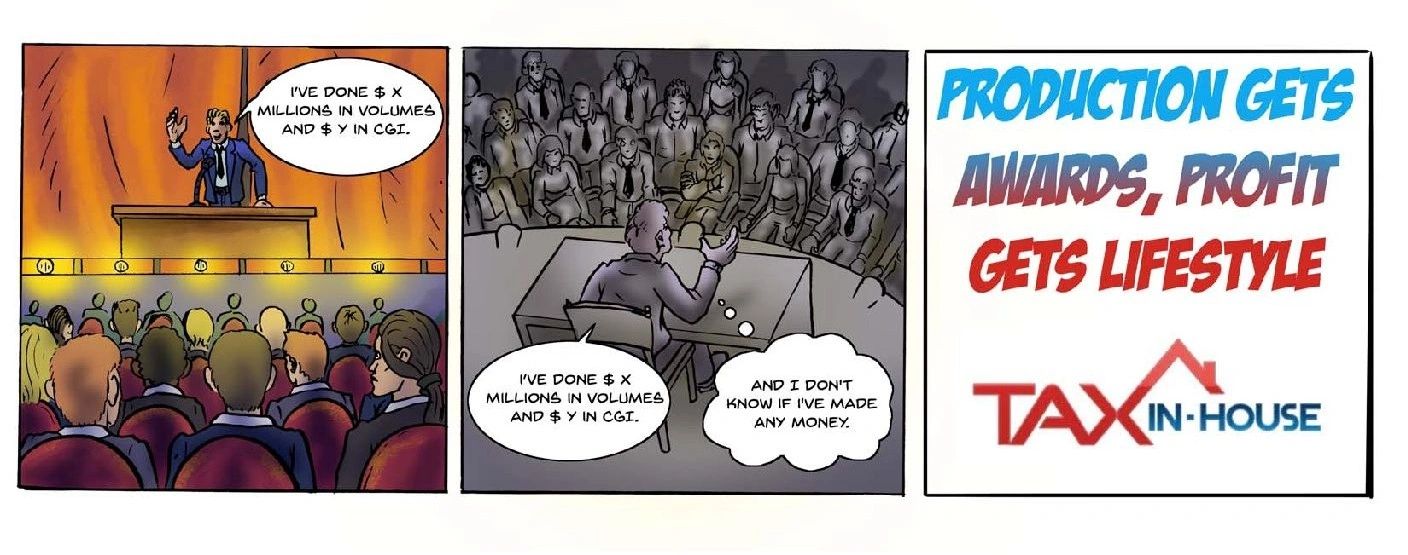

Tax In-House is an educational firm that happens to do tax and bookkeeping. Our only product is an all-inclusive monthly tax and bookkeeping service for real estate sales agents/teams. This service handles all tax & bookkeeping minutia associated with an S-Corp while also offering conversation and education about what the numbers mean.

MREA is shorthand for Gary Keller's book the Millionaire Real Estate Agent. This book outlines a path and business models from new agent to true business owner. We use the chart-of-accounts* provided in this book while our deep understanding of its goals allows us to help agents implementing best practices.

*a chart-of-accounts is merely a list of categories for categorizing business expenses

Yes! Tax In-House strives to remove all tax and bookkeeping minutia from agents' plates. This includes helping resolve any matters raised in a tax notice or similar document.

Occasional emails musings about tax, accounting, and business matters that affect real estate agents

Copyright © 2025 Tax In-House - All Rights Reserved.

Knowledge is power, control your future

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.